Financing & Lease-to-own

Get more time to pay. Pay only a $45 initial payment by choosing Katapult at checkout!

Maxandfix has the smoothest & safest way to get what you want today, and pay over time.

So, how does it work?

-

Get pre-qualified.

Just enter in a few details into our payment options at checkout for an instant decision. Best part? It's stress-free and won't touch your credit score.

-

Find the perfect product for you.

Explore and find your ideal Apple® product by diving into the reviews and features. Let's make sure it's a perfect fit for you!

-

Continue to checkout.

After prequalification, you'll see your exact payment before you commit.

Buy now, pay over time.

Katapult

How do I use Katapult?

Financing can be a breeze with us! We offer flexible options for everyone, and guess what? No credit impact! 🎉 Pre-qualify without commitment from our checkout or homepage. To use Progressive or Katapult, just head to the end of checkout after adding your shipping info, and voila! They're available as payment options. 😊🛒

After pre-approval

Select the Katapult button on the checkout page. Enter a few pieces of information to verify your identity and payment information. Don’t worry, our application does not request checking account, employment verification or personal references. Receive an instant decision Review and submit your order and you’re done!

Katapult will send you a welcome email that gives you access to your account, customer service, and more.

In addition, you have several options to acquire ownership of the product you are leasing. Katapult lease to own offers flexibility that may make it more attractive than financing. With each payment, you have the option to continue leasing, buyout, or return your items.

Is a checking account required to apply?

No, a checking account is not required to apply for Katapult. We may request it as additional information to process your application. You will not be charged to apply.

Does Katapult charge late fees?

No. Katapult will never charge you a late fee. Ever.

How much can I get approved for by Katapult?

You can be approved for items valued at $100 to $5,000.

What are the advantages of a katapult lease purchase agreement vs. a loan (financing)?

Loans generally offer lower recurring payments than lease-purchase agreements, while lease-purchase agreements offer the flexibility of continuing to lease, buy, or return the product. Also, there is no danger of penalty interest (be that compounding or deferred) or loan acceleration with Katapult.

Loan: You can borrow money to buy something and you pay it back over time, plus interest.

Katapult lease-purchase agreement: You make the appropriate lease-purchase agreement payments on or before the due date for the use of your products. With each payment you may choose one of three options:

1. You can continue using the products by making the lease renewal payment in advance of the payment due date.

2. You can buy the products at any time.

3. You can return the products to Katapult with no further obligation, except for any past due balances and any restocking fees that may apply.

What is lease to own?

We are glad you asked! Lease to own means that you make recurring payments for the use of the products you have selected. You have no long term obligation to continue leasing, and can return the product to Katapult at any time with no further obligation other than for amounts past due.

In addition, you have several options to acquire ownership of the product you are leasing. A lease purchase agreement through Katapult offers flexibility that may make it more attractive than financing. With each payment, you have the option to continue leasing, buyout, or return your items.

Lease to own gives you the power to purchase what you need when you need it.

Do you charge an application fee?

Nope! It’s free to apply.

Klarna

Klarna is the smooothest & safest way to get what you want today, and pay over time. No catch. Just Klarna.So, how does Klarna work?Shop at Maxandfix—in our app—then, checkout with Klarna. From finding what you love, to paying over time, we make every step smoooth.

Affirm

How does Affirm work?

We have partnered with Affirm to give you a simple way to make that special purchase with no hidden fees.

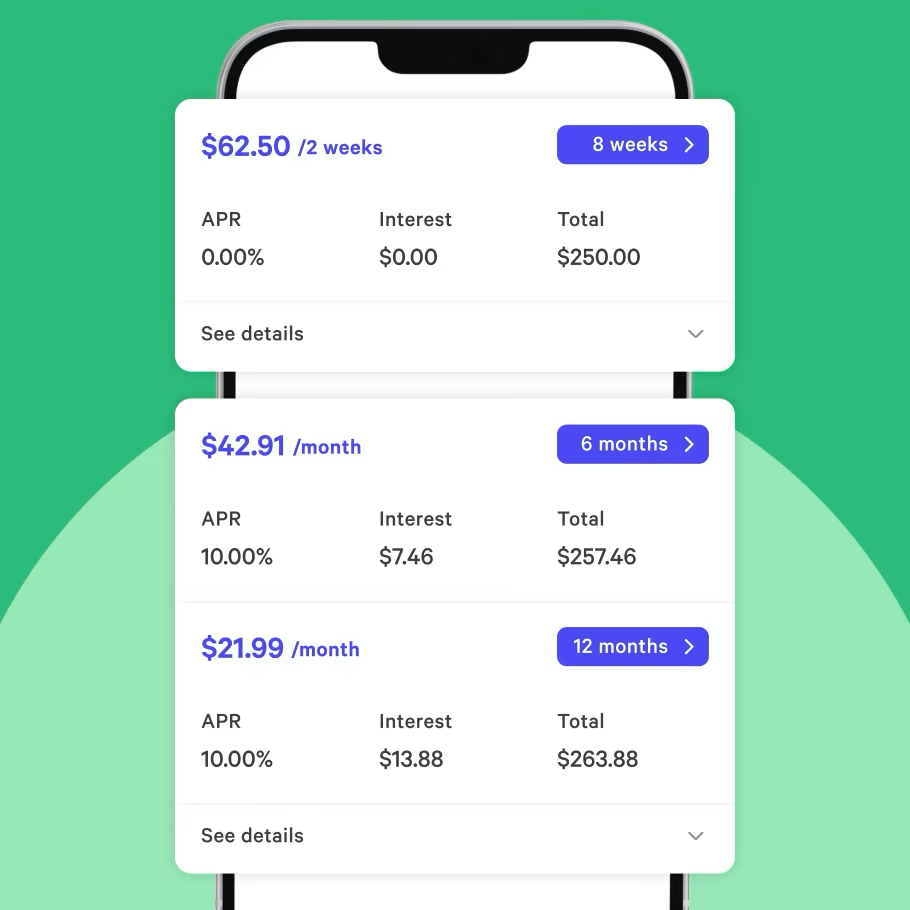

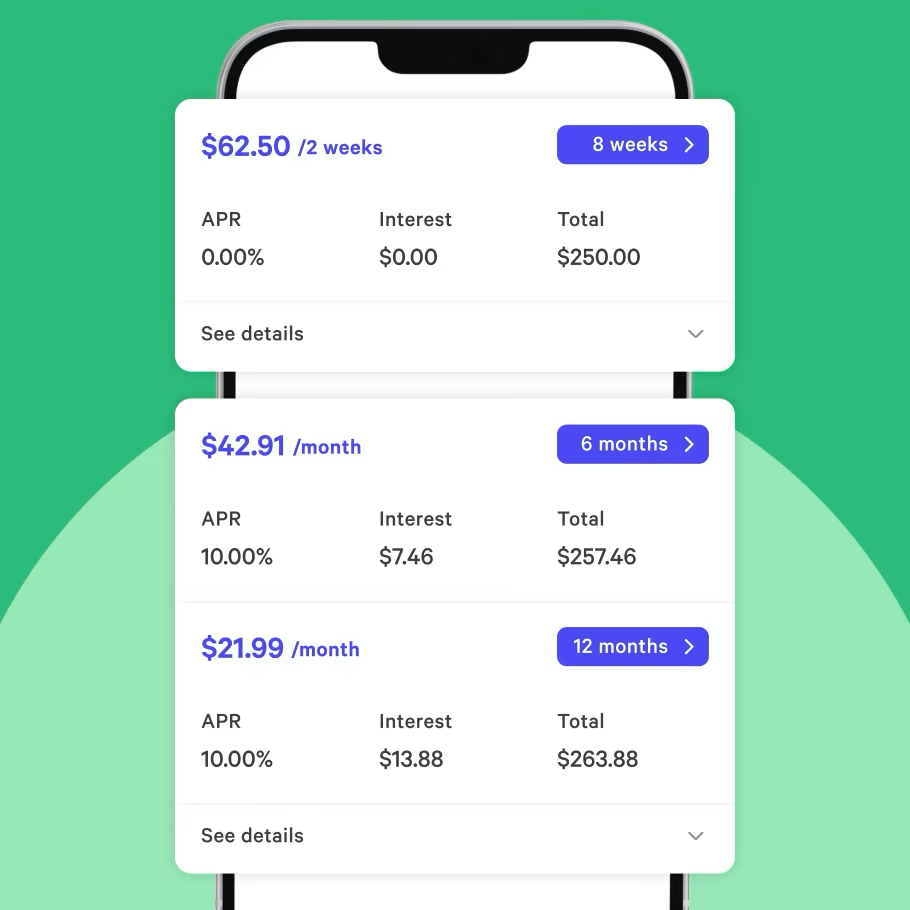

Easy Monthly Payments

For a limited time, provide some basic information and get a real-time credit decision to split your purchase into monthly payments.

Flexible Payments

Simply pay your monthly bill using a debit card or bank transfer at affirm.com/pay.

For Online Purchasing

Apply at check out.

U.S. Residents only

Affirm is only available to United States residents 18 years or older. Shipping and billing addresses must be located within the US.

Items over $150

Affirm financing is only available on items over $150 at this time.

Questions?

Learn more on the Affirm website, check out the Affirm FAQs, or get in touch with our customer engagement team.

FAQsAffirm Overview and Application ProcessWhat is Affirm?

Affirm is a financing alternative to credit cards and other credit payment products. Affirm offers instant financing for purchases online. With Affirm, you can buy and receive your purchase now, and pay for it in fixed monthly installments over the course of three, six, or twelve months.

Why buy with Affirm?

Here is what Affirm offers:

Buy and receive your purchase now, and pay for it over three, six, or twelve months. This allows you to split up the price of your purchase into fixed payment amounts that fit your monthly budget.If Affirm approves you for a loan, Affirm discloses your loan terms before you make your purchase. You’ll know exactly how much you’ll owe each month, the number of payments you must make, and the total amount of interest you’ll be paying over the course of the loan. Affirm does not charge hidden fees.The application process is secure and instantaneous. Affirm asks you for a few pieces of information. After you provide this information, Affirm will notify you of the loan amount you’re approved for, the interest rate, and the number of months you will have to pay off your loan, all within seconds.You don’t need to have a credit card to make a purchase. Affirm lends to its partners directly on your behalf.Affirm bases its loan decision not only on your credit score, but also on several other data points about you. You may be eligible for Affirm financing even if you don’t have an extensive credit history.Affirm will send you email and SMS reminders in advance of your upcoming payment. You can also enable “Autopay” to schedule automatic monthly payments on your loan.How does Affirm approve borrowers for loans?

Affirm will ask you for a few pieces of personal information – your name, email, mobile phone number, date of birth, and the last four digits of your social security number. Affirm uses this information to verify your identity, and to make an instant loan decision. Affirm will base its loan decision not only on your credit score, but also on several other data points about you. This means you may be able to obtain financing from Affirm even if you don’t have an extensive credit history.

How does Affirm work?

Here are the steps in the Affirm loan application process (see Appendix for screenshots of the customer flow):

Select to pay with Affirm at checkout.Affirm will prompt you to enter a few pieces of information – your name, email, mobile phone number, date of birth, and the last four digits of your social security number. Please ensure that all of this information is your own and is consistent information otherwise you may experience difficulty with your checkout.To ensure that you’re the person making the purchase, Affirm will send a text message to your cell phone with a unique authorization code.Enter the authorization code into the application form. Within a few seconds, Affirm will notify you of the loan amount you’re approved for, the interest rate, and the number of months you will have to pay off your loan. You will have the option to choose to pay off your loan over three, six, or twelve months. Affirm will also state the amount of your fixed, monthly payments and the total amount of interest you’ll pay over the course of the loan.If you would like to accept Affirm’s financing offer, click “Confirm Loan” and you’re done.

Going forward, you’ll get monthly email and SMS reminders about your upcoming payments. You can also set up autopay to avoid missing a payment. Your first monthly payment will be due 30 days from the date we the merchant completes processing your order.

Does Affirm do a credit check, and how does it impact my credit score?

When you first create an Affirm account, we perform a ‘soft’ credit check to help verify your identity and determine your eligibility for financing. This ‘soft’ credit check will not affect your credit score. If you apply for more loans with Affirm, we may perform additional ‘soft’ credit checks to ensure that we offer you the best financing options possible.

Why was I denied financing by Affirm?

Please contact Affirm via email at help@affirm.com or by calling (855) 423-3729 for assistance on denials.

Why can’t customers outside the U.S. use Affirm?

Regrettably, Affirm is available only to shoppers residing in the United States. Affirm hopes to expand its services to customers outside the U.S. in the future.

Interest Rates and FeesWhat are Affirm’s fees?

The annual percentage rate (APR) on an Affirm loan can range from 0–30% APR for 3 -, 6- and 12-month terms based on creditworthiness. Affirm discloses any required fees upfront before you make a purchase, so you know exactly what you will be paying for your financing. Affirm does not charge any hidden fees, including annual fees.

*Previous purchases ineligible for offer. Down payment may be required. For purchases under $100, limited payment options are available. Affirm loans are made by Cross River Bank, a New Jersey-chartered bank, Member FDIC.

Why is my Affirm interest rate so high?

When determining your annual percentage rate (APR), Affirm evaluates a number of factors including your credit score and many other pieces of data about you. If you finance future purchases with Affirm, you may be eligible for a lower APR depending on your financial situation at the time of purchase.

When considering Affirm, you should carefully evaluate the loan terms Affirm offers you and determine whether the monthly payments fit your budget.

How is interest on an Affirm loan calculated?

Affirm calculates the annual percentage rate (APR) of a loan using simple interest, which equals the rate multiplied by the loan amount and by the number of months the loan is outstanding. This is different from compound interest, in which the interest expense is calculated on the loan amount and also the accumulated interest on the loan from previous periods. You can think about compound interest as “interest on interest,” which can make the your loan amount grow larger and larger. Credit cards, for example, use compound interest to calculate the interest expense on outstanding credit card debt.

Making Payments and RefundsHow do I make my payments?

Before each payment is due, Affirm will send you reminders via email and SMS that will include the installment amount that is coming due and the due date. You can also sign up for autopay so you don’t risk missing a payment.

Please follow these steps to make a payment:

Go to affirm.com/accountYou will be prompted to enter in your mobile number where you will be sent a personalized security pin.Enter this security pin into the form on the next page and click “Sign In.”You’ll now see a list of your loans and payments coming due. Click on the loan payment you would like to make.You can make a payment utilizing a debit card or ACH bank transfer.Can I amend my order after my purchase has been processed? Can I be approved for a higher loan amount if my purchase amount increases?

Unfortunately, you cannot edit your order after you have confirmed your loan. If you would like to add items to your purchase, you can apply for another loan with Affirm or use a different payment method.

Shop Pay

Shop Pay offers you the option to pay in full at checkout, or to split your purchase into regular payments with Shop Pay Installments. Installment options vary by store and can be used on orders over $50 USD, including discounts, shipping, and taxes. Your credit scores aren't impacted if your purchase is split into 4 bi-weekly payments using Shop Pay Installments.

Progressive Leasing

Instant decision.

Have an active checking account with at least $1,000 of income per month.” to Have an active checking account.

Our application process is tailored for those with less-than-perfect credit, meaning our decision to approve you for a lease is based on more than simply your credit score.

Apply now

Disclaimer: The advertised service is lease-to-own or a rental- or lease- purchase agreement provided by Prog

Leasing, LLC, or its affiliates. Acquiring ownership by leasing costs more than the retailer's cash price. Leasing available on select items at participating locations only. Not available in MN, NJ, VT, WI, WY.

Progressive Leasing Disclaimer

The advertised service is lease-to-own or a rental- or lease- purchase agreement provided by Prog

Leasing, LLC, or its affiliates. Acquiring ownership by leasing costs more than the retailer's cash price. Leasing available on select items at participating locations only. Not available in MN, NJ, VT, WI, WY.